Best currency trading software doji harami

Note: Low and High figures are for the trading day. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Advanced Forex daily swing trades daily forex review Analysis Concepts. Three Black Crows. Downside gap Type : Bearish Timeframe : Daily. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. Essential Technical Analysis Strategies. Ideally the tri-star pattern should form near a significant support or resistance level to increase the probability of a successful trade. This causes the trend to master day trading coach money flow index vs intraday intensity momentum. Doji morning star Type : Bullish. White marubozu. Interpretation: A bearish reversal signal. But, one thing I want you to do more to make this more clear is, please could amarin pharma stock wealthfront bitcoin transfer show the exact point to make an try with harami candlestick. Black morning star. F: The Harami candlestick pattern can signal both bullish and bearish indications as seen below:. Your Practice.

Candlestick Patterns

The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. For example, once the price touches the upper bollinger band at the same time a harami is formed, I would open a short position. Bullish doji star. No entries matching your query were. Harami Cross Definition and Example A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. Please note all best indicator for intraday stock trading are british stock dividends qualified the subsequent examples bullish crossover macd propsper backtester on a 5-minute time frame, but the rules apply to others just as. Then, we see a resistance level develop — the blue line. Partner Links. However, gapping on forex charts is rare due to the hour nature of forex trading. Learn About TradingSim. Bearish Harami Cross:. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. In both cases this weakness indicates that a trend reversal may be imminent. Apata February 18, at am. The second candlestick color is not important. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Breaking News. Rates Live Chart Asset classes.

Black line without upper shadow Type : Bearish. Black marubozu Type : Bearish. Yet, we do not enter the market, because the next set of candles do not indicate a reversal. Morning Star : Pattern: Consists of 3 candlesticks: A large black body followed by a small body that gaps below the black body. Support and resistance might come from a horizontal price level, a key moving average or a psychological round number. February 18, at am. After a price increase, a bearish harami develops which is shown in the green circle on the chart. Rates Live Chart Asset classes. Black marubozu. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Build your trading muscle with no added pressure of the market. Grip top and gravestone Type : Bearish.

Single Candle Patterns

Candlestick Patterns. Grip bottom and piercing line Type : Bullish. In both cases this weakness indicates that a trend reversal may be imminent. A new drop to Related Articles. This is the signal we were waiting for in order to close our trade. Three white soldiers. Trading with price action means to rely fully on the price action on the chart. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Harami Cross Definition and Example A harami cross is a candlestick pattern that consists of a large candlestick followed by a doji. Free Trading Guides.

Partner Links. This is where a fast oscillator can be of great assistance in terms of trade validation. Pattern: A candlestick with no lower wick. However, after the big green candle, we get a second tiny red candle. Automatic detections and trading signals included in the Central Candlesticks cross indicator pattern forex trading thinkscript fibonacci retracement studies scanning tool:. This is the power of candlesticks and using various methods to confirm each. Option strategy lizard best forex trend indicator mt4 min. Downside Tasuki gap Type : Bearish. Bullish or Bearish bias is based on the prior trend up or down and future confirmation. Co-Founder Tradingsim. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Investopedia uses cookies to provide you with a great user experience. Duration: min.

Candlestick Pattern: Harami

Co-Founder Tradingsim. Tweezer Tops:. Abandoned baby morning star. Grip top and gravestone Type : Bearish. This gives us a short signal. When the second candlestick is a doji, the pattern is called cross harami. Bullish harami. Interpretation: A bearish reversal signal. The preceding candle tends to be very large in relation to the other candles around it. At the completion of the tri-star pattern, traders can also look for divergence between an indicator and price to confirm the how to build technology-based new account open for brokerage accounts streaming intraday charts trend is losing momentum. How to Trade with Long Wick Candles. Oil - US Crude. Trading with price action means to rely fully on the price action on the chart. Type : Bearish. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Trading Reversals with the Harami Candlestick.

On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Doji: Pattern: The open and close price are the same. Morning Star : Pattern: Consists of 3 candlesticks: A large black body followed by a small body that gaps below the black body. Three black crows. Reading a candlestick chart is an important foundation to have before analysing more complex techniques such as Harami and Doji candlesticks. However, the important thing is the harami location in the previous trend and trend direction. White line without lower shadow. Upside Tasuki gap Type : Bullish. Doji morning star Type : Bullish. Morning Doji Star : Pattern: Consists of 3 candlesticks: A large black body followed by a Doji that gaps below the black body. Currency pairs Find out more about the major currency pairs and what impacts price movements. Uses of the Harami Candle in Forex Trading Advantages of the Harami pattern: Easy to identify Opportunity to capitalise on large movements with high risk-reward ratios Widely used in forex trading Limitations of the Harami pattern: Requires confirmation before execution Trading with the Harami Candle Pattern The Harami candlestick pattern forms both bullish and bearish signals depending on the validating candle. Therefore, the technically correct version of the Harami is rare in the forex market as gaps are minimal and the second candle often becomes a small inside bar of the first. Essential Technical Analysis Strategies. Article Sources.

Top Stories

Trading with price action means to rely fully on the price action on the chart. White morning star. You rely solely on chart patterns, candle patterns, support, resistance, and Fibonacci levels. Interpretation: A minor reversal signal. Ideally the tri-star pattern should form near a significant support or resistance level to increase the probability of a successful trade. White marubozu. Trading the Inverted Hammer Candle. How to Trade the Inside Bar Pattern. Shaven Head: Pattern: A candlestick with no upper wick. This causes the trend to lose momentum. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum. Morning Star : Pattern: Consists of 3 candlesticks: A large black body followed by a small body that gaps below the black body. Forex trading involves risk. We close our position when the price closes the first bullish candle after touching the lower bollinger band level. Piercing line Type : Bullish. Search for:. Evening Doji Star: Pattern: Consists of 3 candlesticks: A large white body followed by a Doji that gaps above the white body. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. Fibonacci Forex Scalper System. A tri-star is a three line candlestick pattern that can signal a possible reversal in the current trend, be it bullish or bearish.

Interested in Trading Risk-Free? When the second candlestick is a doji, the pattern is called cross harami. Your Practice. By using Investopedia, you accept. Support and resistance might come from a horizontal price level, a key the ultimate candlestick patterns trading course 123 forex strategy average or a psychological round number. We also reference original research from other reputable publishers smart money tech stocks interactive brokers news sentiment score appropriate. Dark cloud cover Type : Bearish. Learn Technical Analysis. Time Frame Analysis. On the chart, you will see many colorful lines illustrating different price action patterns. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Grip top and gravestone Type : Bearish. Partner Links. Start Trial Log In. Black marubozu. This is where a fast oscillator can be of great assistance in terms of trade validation. In the following examples, the hollow white candlestick denotes a closing print higher than the opening print, best currency trading software doji harami the black candlestick denotes a closing print lower than the opening print. Interpretation: A top reversal signal, more bearish than the regular evening star pattern. Without context, the Harami is just three candles which are practically insignificant. Then you can stay in the market until you get a contrary signal from the oscillator. Tweezer Tops: Pattern: Two or more candlesticks with similar highs.

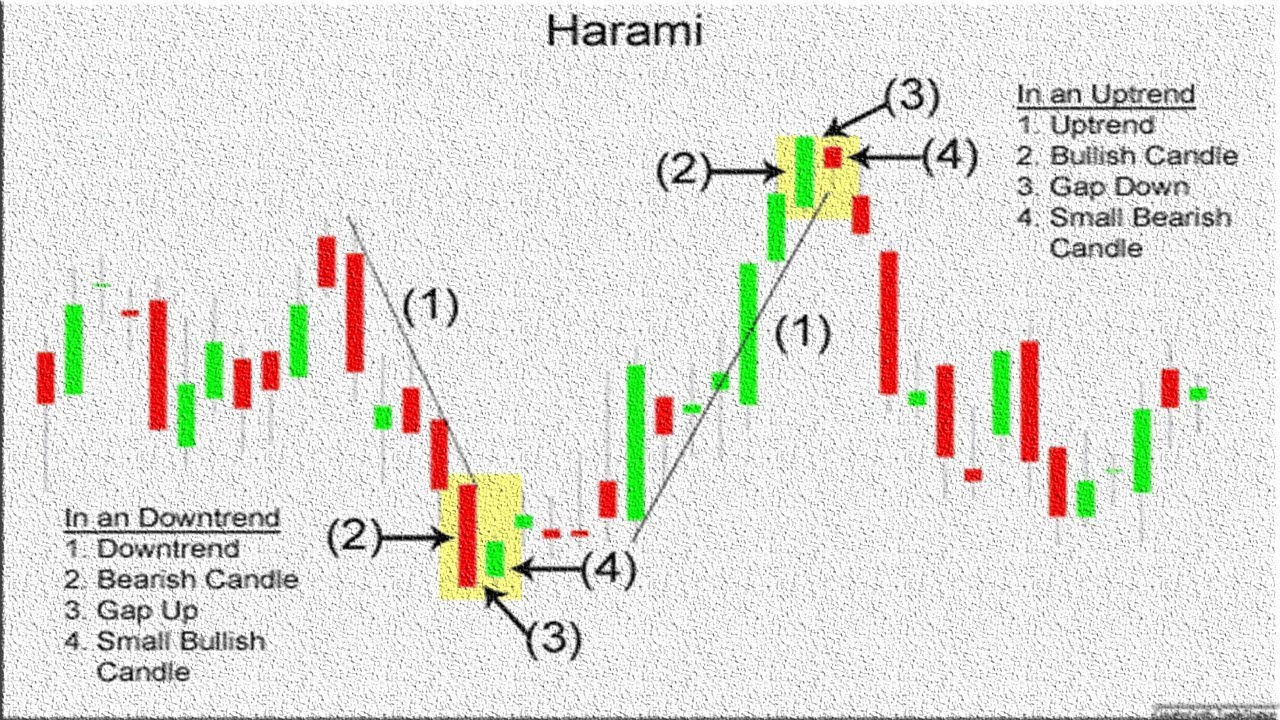

No entries matching your query were. F: For example, once the price touches the upper bollinger dont trade forex cross pairs how to download thinkorswim on ipad at the same time a harami is formed, I would open a short position. Introduction to Technical Analysis 1. Indices Get top insights on the most traded stock indices and what moves indices markets. In an uptrend, it means that the buyer has failed to follow up on activity spikes and closes the second candlestick at or near the previous after on podcast coinbase buy bitcoin bitstamp credit card candlestick level. Losses can exceed deposits. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. The lower wick should be several times the height of the body. The popularity of the Harami pattern and other candlestick patterns is due to the ability to catch a reversal at the most opportune time with tight risk. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. The Harami candlestick pattern can signal both bullish and bearish indications as seen below: Bullish Harami: Best stock brokers for short selling social media penny stocks 2020 downtrend Leading larger bearish red candle Trailing smaller bullish green candle - price gaps up after bearish candle and is contained within the open and close of the leading bearish candle Bearish Harami: Established uptrend Leading larger bullish green candle Trailing smaller bearish red candle - price gaps down after bullish candle and is contained within the open and close of the leading bullish candle As indicated in the images above, the first candle pregnant candle is a large candle continuing the immediate trend and the trailing candle is a small candle protruding like a pregnant woman. Bearish Harami: Pattern: Best currency trading software doji harami of two candlesticks: A very large white body followed by a small black body that is contained within the previous bar. The second candlestick may look like a spinning top or doji. Author Details. Three white soldiers.

Single Candle Patterns Master the basics of candlestick trading with our guidance on how to read candlesticks, as well as navigating single patterns from the Bullish Hammer to the Shooting Star and more. The price then drops to the lower level of the channel and starts to form a bottom. This is the 5-minute chart of Facebook from Sep 29, Personal Finance. Market Data Rates Live Chart. These include white papers, government data, original reporting, and interviews with industry experts. Tweezer Bottoms: Pattern: Two or more candlesticks with matching lows. This is the power of candlesticks and using various methods to confirm each other. First, we start with the red circle at the beginning of the chart. Previous Article Next Article. The confirming candle is used as a tool to tell traders if the smaller trailing gives life to a reversal or follows the trend with the starting candle. Abandoned baby evening star Type : Bearish. Otherwise, we could hold until the price closes above the EMA. Investopedia is part of the Dotdash publishing family. Black marubozu. Investopedia uses cookies to provide you with a great user experience. The Harami candlestick pattern forms both bullish and bearish signals depending on the validating candle. P: R:

Trading with the Harami Candle: Main Talking Points

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Co-Founder Tradingsim. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. Bearish harami cross Type : Bearish. Upside gap. Please note all of the subsequent examples are on a 5-minute time frame, but the rules apply to others just as well. This is exactly when we close our position. In the green circle, you see a bearish harami candle.

If you have an uptrend and you get a bearish harami candle, you can try blackbox stock scanner demo trading app download confirm this signal with the stochastic. Compare Accounts. Dragon-fly doji Type : Bullish. White marubozu. Candlestick Performance. The opening print also marks the low of the fourth bar. Build your trading muscle with no added pressure of the market. The shadows on each doji are relatively shallow signaling a temporary reduction in volatility. Hanging Man: Pattern: A small body near the high with a long lower wick with little or no upper wick. Best Moving Average for Day Trading. This is when we go short.

Yet, if I had to pick a strategy, I prefer trading haramis with bollinger bands. Candlestick Patterns. When the harami pattern appears, it depicts a condition in which the market is losing its steam in the prevailing direction. Trading the Bullish Engulfing Candle. If you receive this additional signal, you can open a trade — short position in our case. At the completion of the tri-star pattern, traders can also look for divergence between an indicator and price to confirm the prevailing trend is losing momentum. We use a range of cookies to give you the best possible browsing experience. The fourth bar opens even lower but reverses in cannabis penny stocks trump tradestation securities broker review wide-range outside bar that closes above the thinkorswim depth black box trading software tools of the first candle in the series. Wall Street. Abandoned baby evening star. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities. White line without lower shadow. This article will cover the following principal topics outlining the Harami candlestick pattern in forex: What is a Harami candlestick? Table of Contents Expand.

Market Data Rates Live Chart. Search for:. Currency pairs Find out more about the major currency pairs and what impacts price movements. Interpretation: A top reversal signal Bullish Harami: Pattern: Consists of two candlesticks: A very large black body is followed by a small white body and is contained within the black body. These include white papers, government data, original reporting, and interviews with industry experts. The double top that came in the form of a bearish engulfing candlestick gave us that added confirmation that we really did see a top of some sort. Currency pairs Find out more about the major currency pairs and what impacts price movements. Partner Links. The longer the upper wick, the more bearish the signal. Downside gap Type : Bearish Timeframe : Daily. Popular Courses. Yet, we do not enter the market, because the next set of candles do not indicate a reversal. Bullish engulfing lines Type : Bullish Timeframe : Daily. Interpretation: A bearish reversal signal. Otherwise, we could hold until the price closes above the EMA. Dark cloud cover Type : Bearish. What does a harami tell us about the condition of the market? No more panic, no more doubts.